Schumacher Center for a new economy

https://www.youtube.com/watch?v=P1Ql87-Y620#t=170

Gar Alperovitz as speaker, starts with the question "Who are you?" that is what matters.

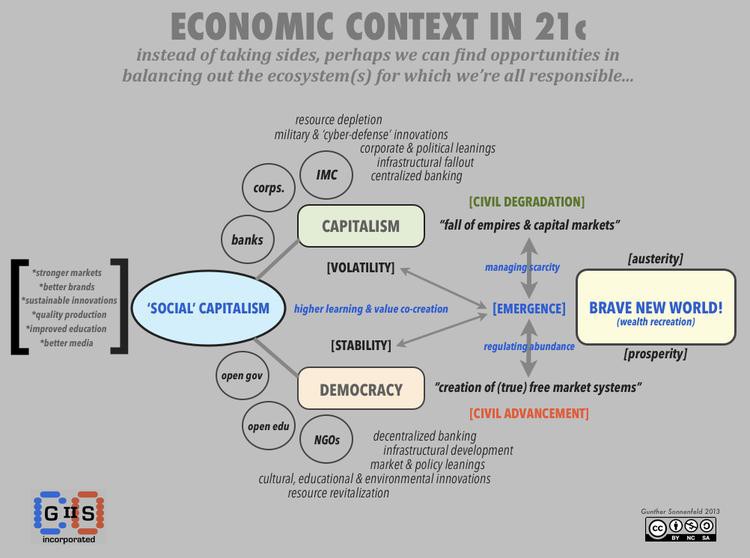

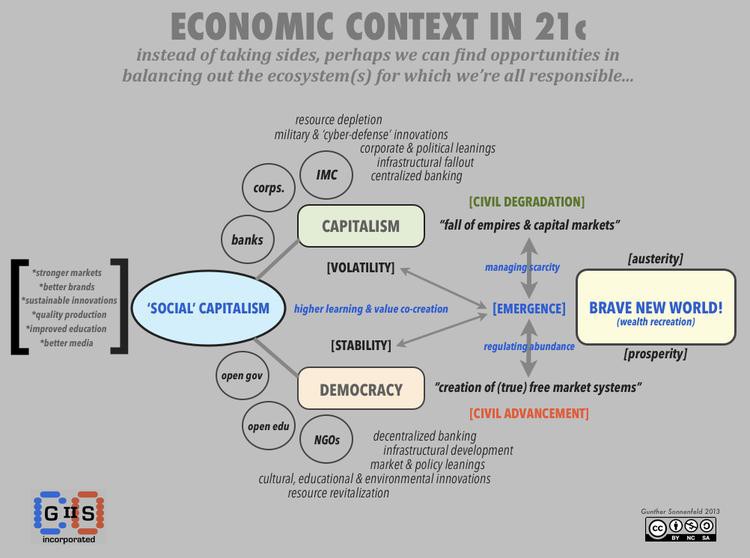

This tubby is part of the article in the link below. I follow Gunther Sonnenfeld on LinkedIn,

I think he's an interesting trailblazer, who lived through a near death experience.

Excerpt from article by Gunther Sonnenfeld:

........“I wouldn’t go to war again as I have done to protect some lousy investment of the bankers.

There are only two things we should fight for. One is the defense of our homes and the other

is the Bill of Rights. War for any other reason is simply a racket.”

— Former Major General, Smedley Darlington Butler

Cut to present day, we haven’t defended our homes (we’ve literally gutted them with collateralized debt obligations),

nor have we defended the Bill of Rights (the last four administrations have done an excellent job of systematically

eradicating our civil liberties).

Yet, aren’t these foundations what make America great?

I’m not talking about the illusion of low interest rates, or deflationary risks, or ‘quantitative easing’, or any other

false narrative that spuriously brings ‘confidence’ to the capital markets. I’m talking about more than half of America’s youth —

college graduates — who don’t have jobs, and have little hope in attaining any, anytime soon. I’m talking about legions of

entrepreneurs who are bootstrapping their ideas and are receiving very little if any help from banks, and are the unfortunate

rejects in a system that wants to impose significant caps on things like equity crowdfunding, under the auspices of ‘protecting

investors’. As with most regulatory bodies, we know the SEC is incompetent, so why isn’t someone like you (who has reportedly

invested in several of these types of platforms) helping to shape the Title III regs more equitably, and figuring out more ways to

hybridize investment using the bank’s cash and lines of credit?......."(full article in the link below)

Written on Jan 17 by

Gunther Sonnenfeld

CIO, @Faveeo (social web intelligence). Partner,

Luman (social innovation). Partner,

Codemonkeys (tech development).

Advisor, @Verizon digital, @CoinOfSale

https://medium.com/@goonth/an-open-letter-to-jamie-dimon-ed1ff96f85be

https://www.youtube.com/watch?v=P1Ql87-Y620#t=170

Gar Alperovitz as speaker, starts with the question "Who are you?" that is what matters.

This tubby is part of the article in the link below. I follow Gunther Sonnenfeld on LinkedIn,

I think he's an interesting trailblazer, who lived through a near death experience.

Excerpt from article by Gunther Sonnenfeld:

........“I wouldn’t go to war again as I have done to protect some lousy investment of the bankers.

There are only two things we should fight for. One is the defense of our homes and the other

is the Bill of Rights. War for any other reason is simply a racket.”

— Former Major General, Smedley Darlington Butler

Cut to present day, we haven’t defended our homes (we’ve literally gutted them with collateralized debt obligations),

nor have we defended the Bill of Rights (the last four administrations have done an excellent job of systematically

eradicating our civil liberties).

Yet, aren’t these foundations what make America great?

I’m not talking about the illusion of low interest rates, or deflationary risks, or ‘quantitative easing’, or any other

false narrative that spuriously brings ‘confidence’ to the capital markets. I’m talking about more than half of America’s youth —

college graduates — who don’t have jobs, and have little hope in attaining any, anytime soon. I’m talking about legions of

entrepreneurs who are bootstrapping their ideas and are receiving very little if any help from banks, and are the unfortunate

rejects in a system that wants to impose significant caps on things like equity crowdfunding, under the auspices of ‘protecting

investors’. As with most regulatory bodies, we know the SEC is incompetent, so why isn’t someone like you (who has reportedly

invested in several of these types of platforms) helping to shape the Title III regs more equitably, and figuring out more ways to

hybridize investment using the bank’s cash and lines of credit?......."(full article in the link below)

Written on Jan 17 by

Gunther Sonnenfeld

CIO, @Faveeo (social web intelligence). Partner,

Luman (social innovation). Partner,

Codemonkeys (tech development).

Advisor, @Verizon digital, @CoinOfSale

https://medium.com/@goonth/an-open-letter-to-jamie-dimon-ed1ff96f85be