Move. Why do you think you see all those Florida license plates in New York state? “A lot of people in high tax states pretend very aggressively they live in Florida,” says Shenkman. Moving to avoid state death taxes works–if you really move to a death-tax-free state and give up all ties to your old state. If you’re two-timing, it’s harder to beat the tax collector, but you can do it if you do it right.

That means changing your driver’s license and registration, where you vote, and religiously recording the number of days you spend in your old and new state. Tax authorities even look at your possessions (your expensive wine collection) that are dear to you to determine where you’re “domiciled.”

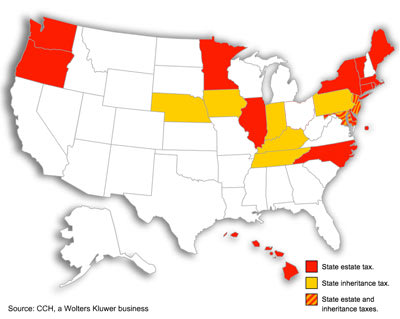

Nevada has no income or estate taxes.Hawaii: 5.25 million exemption - Top tax rate 16%

Oregon: 1 million exemption - Top tax rate 16%

Washington: 2 million exemption - Top tax rate 19%Credit Shelter Trust/Bypass Trust. The credit shelter (or bypass trust) was the mainstay of estate planning back when the federal estate tax was what got families into estate planners’ offices. Now you can still

set up one of these trusts at the death of the first spouse and shelter the amount of the estate equal to the state estate tax exemption amount, with the rest going into a marital Q-TIP trust.With this plan, you pay no state or federal taxes at the first spouse’s death. To shelter the rest of the first spouse to die’s federal exemption, you rely on a provision of the new federal law called “portability,” allowing surviving spouses to carry over the estate tax exemption of the spouse who died first and add it to their own. So married couples can transfer $10.5 million together federal tax-free. Note: states do not have a similar portability provision, so couples can’t as easily double the state exemption amount.

In most cases, you’ll want the bypass trust to be automatically funded, but it’s important to put flexibility into the trust, giving the executor the ability to fund it or not, and giving the trustee the ability to unravel it in the future.

Spousal Lifetime Access Trust. Some estate planners say these trusts will be the future of estate planning—for folks who want to get more out of their estate while they are alive. It works much like putting life insurance in an irrevocable life insurance trust, keeping the cash value and the proceeds out of your estate. The new tax law made permanent a combined $5 million per person lifetime gift tax/estate tax exemption. If you put property in a trust for the benefit of your spouse and kids that gets it – along with any appreciation– out of your estate.

You start by putting say $500,000 into one of these trusts during your life, and add to it as you feel comfortable giving the money away, lessening your estate for federal and state estate and/or inheritance tax purposes each time you make a lifetime gift to the trust. Say you live in New York with its $1 million estate tax exemption, then you could fund the trust until you’re left with $1 million. The upside: Your spouse can access the trust during your life, so you have access to it in a way. The downside: it’s best to have a rock solid marriage for this to make sense.

Outright Gifts. This is the easiest solution—and makes the most sense if your intended recipients need the money now and the amount you’re giving away is not a large number relative to your wealth. In addition to the $5 million lifetime gift allowance, e

ach taxpayer can give any number of individuals $14,000 a year each without worrying about gift tax. Connecticut is the only state that still has a gift tax; it applies to cumulative gifts over $2 million. Tennessee abolished its gift tax last year. You can also pay college or private school tuition and medical bills as long as you pay the provider directly and it doesn’t count against your lifetime gift tax exemption.

A few caveats about “gifting.”

If you want to make sure the money is going to be used the way you want, use a trust instead of an outright gift. Don’t gift low-basis assets: if you paid $10,000 for stock and it’s worth $100,000 when you give it away, the recipient keeps your old $10,000 basis and would owe capital gains tax eventually when the stock is sold. By contrast, if you leave the same stock to the same person in your will, the recipient gets a stepped-up basis to the value as of your date of death, saving capital gains tax. And lastly, make sure you’re comfortable with giving it away. “You have to be able to afford it,” says Charles D. Fox IV, an estate lawyer with McGuire Woods in Charlottesville, Va.

about the subject, but I wonder if those frozen corpses that chose the re-animation later - you know - the life extension stuff for the rich.. will they ever be charged back-taxes when they come back?

about the subject, but I wonder if those frozen corpses that chose the re-animation later - you know - the life extension stuff for the rich.. will they ever be charged back-taxes when they come back?