The day Europe lost patience with Britain... http://www.reuters.com/article/2011/12/11/us-eurozone-britain-idUSTRE7BA0BD20111211?feedType=RSS&feedName=topNews&rpc=22&sp=trueBRUSSELS | Sun Dec 11, 2011- (Reuters) - It was billed as a summit to save the euro. It may be remembered as the day Europe lost patience with Britain, as most of the continent threw its lot in with EU founding members France and Germany and committed to binding their economies ever more tightly.

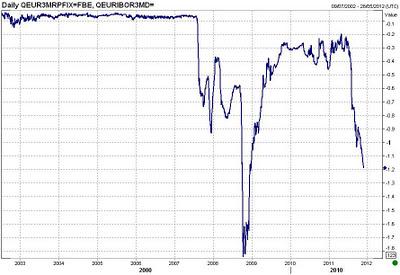

Euro zone fiscal pact fails to restore confidence... Stocks Slide on Debt Doubts... http://www.cnbc.com/id/45639270A fresh round of concern over European debt combined with some downbeat news out of the technology sector to send U.S. stocks sharply lower Monday. Friday's European Union summit produced an agreement to pursue stricter budget rules for the single currency area and also to have euro zone states and others provide up to 200 billion euros ($267 billion) in bilateral loans to the International Monetary Fund (IMF) to help tackle the crisis.

Why Do Banks F?ail Together In A Crisis http://www.cnbc.com/id/45615762Watching Europe's banks teeter on the brink of disaster because of their exposures to sovereign debt has an eerily familiar feel to it.

It is very reminiscent of the near death experience of many of the largest US banks in 2008. Back then it was mortgage-related investments rather than government bonds that weighed down the balance sheets of the banks.One question that a lot of market watchers have is why bank failures seem to cascade. Why do we keep discovering that so many banks apparently follow very similar investment strategies? Don't the banks employ lots of very well paid people to make decisions about which loans to make, which assets to buy, and where to invest? How is it they all keep deciding the same thing?

The fact that so many banks buy the same kinds of assets is what makes for a crisis. If it were just one or two banks that unwisely over-indulged in mortgages or sovereign debt, the financial system could easily handle their failure. This is why, for instance, the failure of MF Global didn't provoke a crisis: most other US financial institutions weren't following Jon Corzine's strategy of loading up on the debt of Italy, Spain and Ireland.

It turns out that there are very good reasons banking is so homogenized. In the first place,

the capital regulations around the world incentivize banks to over-invest in certain favorable asset classes. The rules for capital cushions encouraged banks to buy mortgages and sovereign debt. In Europe, banks weren't required to have any capital cushion at all for sovereign debt, which made government bonds very attractive.

Another factor driving homogenized banking is the potential for bailouts. Banks that buy only what other banks are buying know that they won't fail unless other banks are also failing, in which case central bankers and governments will intervene to prevent a systemic crisis. Banks that strike out on their own are allowed to fail if their bets are wrong.

Read more at link

http://www.cnbc.com/id/45615762Has the Bank Run Begun in Europe? http://www.cnbc.com/id/45417735Former MF Global CEO Jon Corzine Is Really Sorry But Wants His Notes Back http://www.cnbc.com/id/45597964MF Global's Bad Check http://www.cnbc.com/id/45404102Translating Bill Gross: The Debt Trap http://www.cnbc.com/id/45106677Why Is Eric Cantor Blocking the Congressional Insider Trading Act? http://www.cnbc.com/id/45612773n a strange and unexpected twist, the Republican leader in the House of Representatives is now blocking progress on a bill that would definitively outlaw insider trading by federal lawmakers.

'Multiple Layers of Misconduct' http://www.cnbc.com/id/45586601Two former employees of MF Global have brought suit against former CEO Jon Corzine for allegedly misrepresenting the health of the firm, using deceit to get employees to invest in company stock, and squandering that investment on risky European debt.

Euro zone pact fails to restore confidence http://www.reuters.com/Gold set for largest fall in three months http://www.reuters.com/article/2011/12/12/us-markets-precious-idUSTRE7AK1M520111212LONDON | Mon Dec 12, 2011 (Reuters) - Gold was set for its biggest one-day fall in three months on Monday, under pressure from a robust dollar, which in turn choked off demand from consumers in key regions such as India. Last week's summit of European Union leaders yielded a historic agreement on beefing up fiscal discipline in the 27-member bloc, but fell short of market expectations for a more drastic solution to the crisis. This lack of confidence in Europe pushed investors into the relative safety of the U.S. dollar, rather than gold, which has fallen by about 5 percent in the last week alone.

A stronger dollar often encourages non-U.S. holders of gold to sell the metal to lock in a higher profit in their own currencies and in India, the world's largest consumer of bullion, this has kept jewelers and other consumers at bay.

Spot gold was last quoted down nearly 3 percent at $1,659.66 an ounce by 1508 GMT, having dropped by as much as 2.8 percent earlier to a low at $1,662.39, its lowest in three weeks, after breaking through $1,680.00, a major support line.

Euro falls to lowest vs dollar since early October http://www.reuters.com/article/2011/12/12/us-markets-forex-idUSTRE7AC15W20111212NEW YORK | Mon Dec 12, 2011 - (Reuters) - The euro slipped to a more than two-month low against the dollar on Monday as disappointed investors renewed selling of Italian and other government bonds after a summit aimed at ending two years of crisis in the euro zone failed to allay their fears. The euro was last down almost 1.2 percent at $1.3216, after touching a session low of $1.3208, according to Reuters data. That was the lowest since October 4.

No One Telling Who Took $586B in Fed Swaps http://www.bloomberg.com/news/2011-12-11/no-one-says-who-took-586-billion-in-fed-swaps-done-in-anonymity.htmlFor all the transparency forced on the Federal Reserve by Congress and the courts, one of the central bank’s emergency-lending programs remains so secretive that names of borrowers may be hidden from the Fed itself. As part of a currency-swap plan active from 2007 to 2010 and revived to fight the European debt crisis, the Fed lends dollars to other central banks, which auction them to local commercial banks. Lending peaked at $586 billion in December 2008. While the transactions with other central banks are all disclosed, the Fed doesn’t track where the dollars ultimately end up, and European officials don’t share borrowers’ identities outside the continent.

The lack of openness may leave the U.S. government and public in the dark on the beneficiaries and potential risks from one of the Fed’s largest crisis-loan programs. The European Central Bank’s three-month dollar lending through the swap lines surged last week to $50.7 billion from $400 million after the Nov. 30 announcement that the Fed, in concert with the ECB and four other central banks, lowered the interest rate by a half percentage point. More info at link

U.S. Stocks Fall on Moody’s Review; Intel Drops http://www.bloomberg.com/news/2011-12-12/u-s-stock-index-futures-drop-as-germany-opposes-further-ecb-bond-buying.htmlU.S. stocks fell, following a two- week rally in the Standard & Poor’s 500 Index, as Moody’s Investors Service will review the ratings of all European Union countries and Intel Corp. (INTC) said revenue will miss its forecast. Financial companies had the biggest decline among 10 industries in the S&P 500, dropping 3.1 percent as a group. Morgan Stanley and Citigroup Inc. (C) retreated at least 5.4 percent. Intel tumbled 4.1 percent as the world’s largest chipmaker cited a shortage of hard-disk drive supply. Halliburton Co. (HAL), Alcoa Inc. (AA) and Newmont Mining Corp. (NEM) decreased more than 3.2 percent as oil and metal prices slumped. The S&P 500 slid 1.7 percent to 1,233.79 at 10:41 a.m. New York time. The benchmark gauge for U.S. equities rose 8.3 percent over the previous two weeks. The Dow Jones Industrial Average fell 165.71 points, or 1.4 percent, to 12,018.55 today.

Global Slump read more at link above

Goldman a Target of ’Occupy’ West Coast Protests http://www.bloomberg.com/news/2011-12-12/goldman-sachs-top-target-of-occupy-protests-at-west-coast-ports.htmlGoldman Sachs Group Inc. (GS), the fifth- biggest U.S. bank by assets, is a major target of Occupy Wall Street demonstrators who plan to blockade ports from Anchorage to San Diego to cut into profits of the company they blame for helping spur the financial crisis. “They represent the greed of the corporate elite, the 1 percent that’s causing ruin for everybody else,” Michael Novick, a member of Occupy Los Angeles, said of Goldman Sachs in a Dec. 7 telephone interview. The Occupy movement’s slogan is, “We are the 99 percent.” Demonstrators today hope to disrupt the largest U.S. and Canadian container ports -- Los Angeles, Long Beach and Vancouver -- as well as Anchorage; Seattle and Tacoma, Washington; Portland, Oregon, and San Diego and Oakland, California. The economic value of containerized cargo at West Coast ports is about $705 million a day, according to Martin Associates in Lancaster, Pennsylvania.